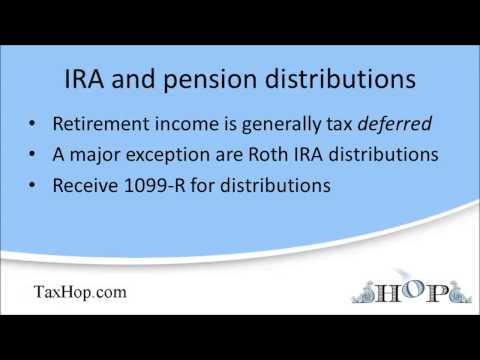

After filling in any net capital gains income on Schedule D, you'll come back to Form 1040. Here, you'll have to include any retirement or pension income that you've received. Money that you stash into your 401k or IRA account is tax deferred, but it's not tax-free. This is the place where the taxman catches up with you and puts an end to your tax deferral. Remember that most income deposited into your IRA or 401k accounts doesn't appear in your taxable income. The tax on this income is deferred further as you work; the money in your retirement account grows completely tax deferred. You won't get any 1099s showing that you have to report income from your tax-sheltered retirement account. However, things change after you retire or otherwise withdraw money from the plan. When you receive money from an IRA, pension, or annuity, you also get a Form 1099 at the end of the year. This form shows the IRS how much you received from the retirement account, and it also shows the amount withheld, if any, by your pension plan for income tax purposes.

Award-winning PDF software

Ira distribution 1099 code 7d Form: What You Should Know

If your plan requirements don't allow you to withdraw all or any part of your retirement account earnings before age 59½, this type of distribution is treated like a Roth IRA, and not like a normal distribution. How is a Code 7 Normal Distribution treated? — In general, the standard tax rate for distributions during the tax year is reduced by the amount of the excess qualified distribution. The reduced rate is usually treated as a personal exemption. If you have other exemptions, then you may not be eligible for any of them. Some states require that distributions from your retirement plan be taxed at a higher rate. Please consult your tax professional to determine what that rate may be. Tax Topic 1019 — Exclusions The first line on your 1099-R should say “No distributions from the plan or account during the year.” A number of states don't treat distributions from retirement accounts the same as other income. You might want to avoid this situation and include that information on page 2 of your 1099-R. Also, some states require retirement plan distributions to be taxed at a higher rate than other income. See Tax Topic 1017 — Exclusion from Income. What is an Exclusion from Income? — FreeTaxUSA An Exclusion is any income you receive that is not taxable. The IRS has set out exemptions for individuals, corporations and trusts. Exemptions are usually in the form of nonrefundable tax credits. For example, the Earned Income Tax Credit is an exemption to income tax while Social Security benefits are Exemptions to income tax. Some Exemptions are for certain types of benefits. Social Security payments, for example, may be exempt if you are 62 or older and receive them at 62 or older. However, this is not necessarily a guaranteed exemption and may depend on the specific type of benefits. If you have any question on Exemptions, please contact your tax advisor. Which type of Exemptions is important for distributions from your retirement plan, 401(k), IRA or other retirement account? (Please note that if you participate in a group health plan such as an employer's 401(k) or 403(b) plan, you will receive the same exemptions as all other plan participants.) Social Security Tax Deduction for Retirement Plans.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1099-R & 5498, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1099-R & 5498 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1099-R & 5498 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1099-R & 5498 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Ira distribution 1099 code 7d